Actively manage spending limits and reduce the risk of fraud

According to the police, card fraud offences come to an average of around 1000 to 2000 francs, if not higher. Or, to put it another way: the fraudsters use the card to buy as many goods as possible – until the limit is exhausted. However, there is a way to limit such losses due to fraud: actively controlling and setting purchase limits.

13.08.2024 –

With most banks, spending limits can easily be actively managed in e-banking via the self-service centre. If you are unsure, you can also contact your customer advisor or the bank's service line. It is recommended that the payment limit be set as low as possible. A simple process to protect yourself from phishing traps and fraud.

Read more News

Protect against phishing and win!

Test how much you know about card security and take part in the big competition by 25 September. Read more

#watchout Phishing-Trap! Police campaign warns against card fraud

With the national card security prevention campaign, the police want to draw attention to all… Read more

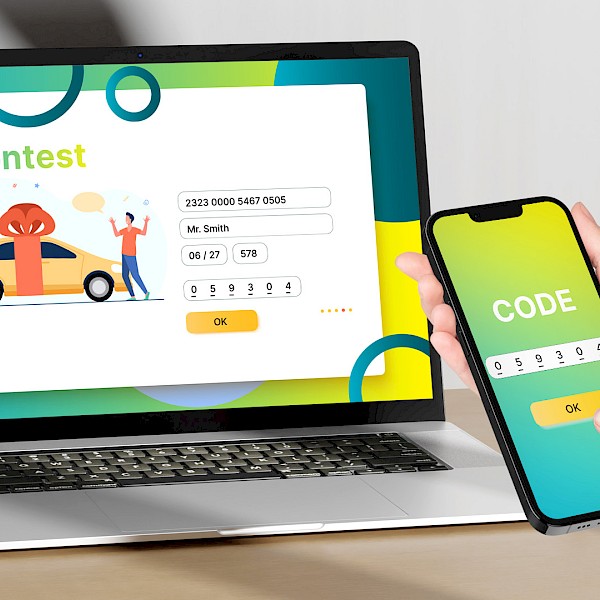

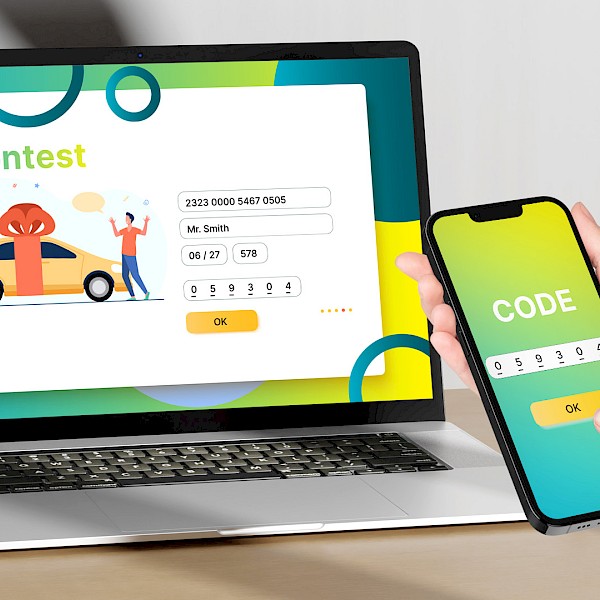

Fake competitions with disastrous consequences!

Competitions usually promise attractive prizes. But sometimes they are also too good to be true. Read more

Duplicitous phishing attempts using the name of PostFinance

Caution is now even required with letters you receive. The phishing attack in the name of… Read more